If you use Woodforest bank and looking to get the answer on Does Woodforest have Zelle payment option, you are on the right post. The answer is not straightforward. This guide will walk you through the steps on how to use Zelle with Woodforest bank including the Zelle limits.

Woodforest National Bank is a privately held brick and mortar bank headquartered in Texas that happens to be Walmart’s largest retail partner. It has a network of over 750 branches spread across 17 states.

Zelle, is a great way to send and receive money instantly without any fees. With Zelle, you can link your US mobile number or email id with a US bank account and then use these details to transfer money instantly.

Does Woodforest Bank have Zelle?

Woodforest Bank does not offer the Zelle transfer option within its mobile banking app and is not on the list of banks that are a part of the Zelle network.

But this is not the end of the road. If you want to use Zelle, there is still a way you can explore by using your Woodforest debit card inside the Zelle App.

Zelle gives you an option to use its service even if the bank is not a part of the network. For this, you need to download the Zelle app on your mobile and register your account with Zelle using your bank’s debit card.

You can add your Woodforest debit card inside Zelle App to start using Zelle with Woodforest bank.

Let’s see the steps on how to use Zelle with Woodforest bank

How to Use Zelle with Woodforest Bank

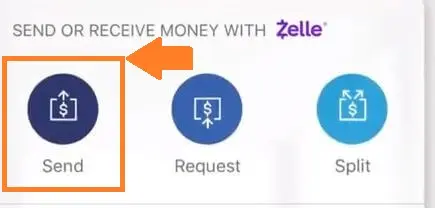

- Download and Install the Zelle App on your mobile

- Set up your account in Zelle with a US mobile number

- Read and Accept the terms of use if agreeable

- It will prompt you to search for the bank. Search by entering “Woodforest” which will be shown not found, you will get the option “Don’t See Bank” tap on it

- It may prompt you to enter your email id to continue. Enter the email id you would like to register on Zelle.

- Next, it brings you the option to enter debit card details. Enter the details of your Woodforest debit card number like card number, zip code, etc.

If all things go well, it should show you a successful registration meaning your Woodforest bank account has been registered with the relevant US mobile number or email.

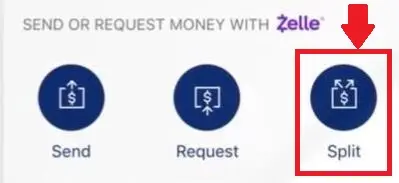

You should be able to now send money using the Zelle App and also receive or accept money from other Zelle users with your registered mobile number.

Make sure to do a test transfer with a small amount to see if it works and if things go as expected.

Woodforest Bank Zelle Limit

Since Zelle is not offered by Woodforest bank, the weekly limit for sending money using your Woodforest Debit card on Zelle is $500 per week i.e. Zelle App’s limit for banks that do not offer Zelle.

Other ways to transfer money with Woodforest

- Transfer money using the Woodforest app or website to transfer to another Woodforest account holder-

If you want to transfer money using someone with a Woodforest bank account, the feature is available right inside the Woodforest app. This is even better than Zelle but only helpful if the other person is using the same bank. - Transfer money by issuing a check-

You can write a check to the person you want to send money. Nowadays, most banks offer a mobile check deposit option so that the check can be deposited from the convenience of the home or on the go. However, in today’s digital world, it can be a pain to write checks and then wait for them to be credited. - Transfer money by ACH this can take 1-3 business days-

You can also send money using the ACH option which is the standard way of transferring money between bank accounts. But again it is not instant as Zelle and takes 1-3 business days for the transfer to go through.

Other Banks you can consider for Zelle transfer

Here is a list of alternate banks that work with Zelle and have the option integrated within their mobile banking app.

- Ally Bank

- Capital One

- Chase

- CIT Bank

- Discover Bank

- Frost Bank

- Wells Fargo

- Bank of America

Wrap Up

It is not an easy route to use Zelle with Woodforest bank. You have to jump through a few hoops like installing Zelle App, linking your debit card, etc. But it can get the job done, but do test it out first. Woodforest Bank has some catching up to do and get this option integrated into its mobile app in the future, as a standard feature that is offered by most banks these days.