In an increasingly digital world, the importance of security of financial transactions cannot be overstated. With the rise in fraud and unauthorized transactions, it makes sense to take proactive steps to protect ourselves. In this guide, we will walk you through one such important precaution- how to lock your Chime card covering all the steps, purpose of using this security feature and benefits.

Contents

Understanding the Importance of Card Locking

Picture this: You’re strolling through a crowded street, and without even realizing it, someone swipes your wallet from your back pocket.

It’s a sinking feeling, isn’t it? Unfortunately, the digital world poses similar risks.

According to recent studies, card fraud incidents have seen a significant surge, affecting millions of people worldwide.

In fact, a report by the Federal Trade Commission (FTC) revealed that there were over 4.8 million reports of fraud in 2020 alone. This makes the protection of your Chime card all the more critical.

Chime is a leading financial technology company providing online banking services with a focus on user-friendly experience. With over 12 million customers, Chime has gained popularity among individuals seeking a modern and convenient banking solution.

Chime offers the feature of card locking on both its Chime debit card and Chime Credit Builder Card, right from within the Chime app.

Understanding the Meaning of Locking Your Chime Card

When you lock your Chime card, you essentially disable its functionality temporarily. This means that no transactions, whether online or in-person, can be authorized using your card during the lock period. It’s like putting a padlock on your wallet to prevent anyone from accessing your funds without your knowledge or consent.

Whether you’ve misplaced your card, suspect fraudulent activity, or simply want an extra layer of security, locking your Chime card puts you in command of your financial well-being.

Locking your Chime card is the first step you can take to prevent any misue of your card. It is a shield against unauthorized transactions.

Remember, locking your Chime card doesn’t affect your account or funds in any way.

It is only a means of preventing any unauthorized use of your card until you decide to unlock it.

So, whenever you’re not actively using your Chime card or suspect any suspicious activity, it’s a smart move to lock it and maintain full control over your financial transactions.

How to Lock Your Chime Card- Step By Step

- Step 1: Accessing the Chime App : To initiate the card lock process, simply launch the Chime app on your mobile.

- Step 2: Navigating to Card Locking: Within the Chime app, locate the “Settings” or “Account Management” section. From there, you’ll find the option to lock your Chime card.

- Step 3: Selecting Your Card: If you have multiple Chime cards, such as a debit card or a credit builder card, make sure you select the correct card to lock.

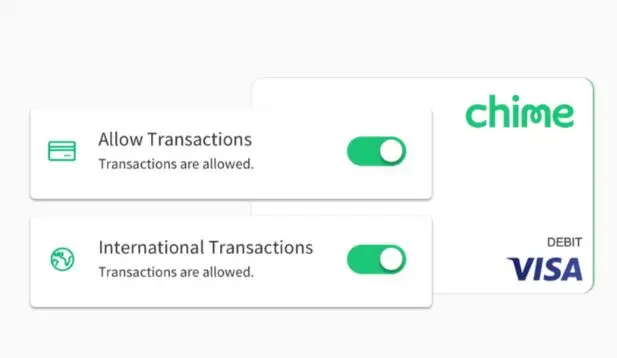

- Step 4: Toggling Card Lock: Once you have identified the appropriate card, toggle the “Allow Transactions” button to the off position. This action instantly locks your Chime card, ensuring that no unauthorized transactions can take place.

Remember, the color green indicates the card is on, while gray signifies that it’s off (i.e.locked).

You can lock it for both local and international transactions.

How to unlock Chime Card

The process of unlocking Chime card is same as above.

Just toggle the back the option to “Allow Transactions” to green following the steps 1-4 above to unlock Chime Card, one you are ready to start using your Chime Card.

Additional Tips for Card Security

While locking your Chime card is an excellent first step, there are additional measures you can take to enhance your overall card security:

- Enable Transaction Alerts: Activate real-time transaction alerts on your Chime app. This way, you’ll be immediately notified of any card activity, allowing you to act swiftly if anything seems suspicious.

- Regularly Monitor Account Activity: Take a proactive approach by regularly reviewing your Chime account for any unauthorized transactions. By catching potential issues early, you can prevent further damage.

- Use two factor authentication or finger print authentication to prevent anyone getting access to Chime App on your mobile

Wrap Up

Securing your Chime card through locking is a convenient and proactive way to minimise possibility of unauthorized transactions. Remember to stay vigilant and take advantage of additional security measures, such as enabling transaction alerts and regularly monitoring your account activity. Stay in control, stay secure, and enjoy the convenience of Chime banking.