If you are using Venmo to make for purchase of goods or services, you may want to know if it is safe to use Venmo and if such transactions are covered by any buyer protection. In this guide, you will get the complete answer to this- if Venmo offers purchase protection, what is the scope and conditions involved for such protection.

Yes, Venmo has a Buyer Protection, that comes into play only when a payment is made to a Venmo Business Profile or when the Buyers tags it as a “Purchase” when sending a payment to a Seller’s personal profile.

Venmo initially offered its services only for sending and receiving money within your circle of trust i.e. friends and family. However, it has expanded its scope to allow commercial transactions.

A seller can accept payments from other Venmo users for goods and services only if it is explicitly authorized by Venmo.

And the authorization can only work in two ways, either

- the seller applies for a Business profile or

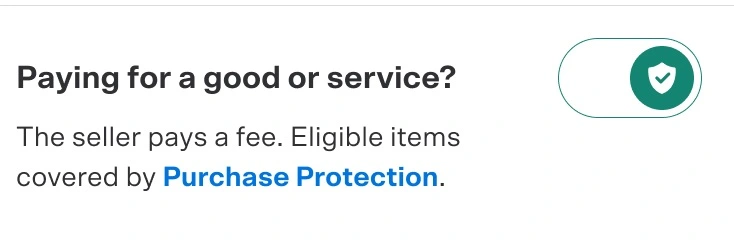

- the Buyer when making payment to the seller explicitly calls out the payment is for goods and services (there is a toggle on option for this)

For transactions that are not covered by the above, it is not going to be eligible for any purchase protection and are not as authorized by Venmo.

Contents

Does Venmo have Buyer Protection?

Yes, when you identify a Venmo payment to a Personal profile as being for purchase OR make a payment to a seller’s Business Profile, it is automatically covered by Venmo Purchase Protection.

In such cases, the Seller has to pay a small fee of 1.9% + $0.10 of the transaction amount, as a cost for the transactions to be covered by Venmo Buyer Protection program. There is no fees on the buyer.

You can contact Venmo afterward if something goes wrong with such transactions to investigate and refund any eligible purchases that did not go as planned.

Venmo Business Profile

Venmo encourages sellers to build a business profile. That way the transactions to such profile are covered by buyer protection.

There are some other benefits to sellers if they create a business profile – being able to receive payments via QR code, more visibility for your business socially by referrals on Venmo, keeping track of business transactions separately from personal ones,

Also when any Venmo Buyer makes a payment to a business profile using a credit card, it is exempt from the standard Venmo fee of 3% on payments funded by credit cards.

This is actually an advantage with Venmo of having an option of purchase protection, as it establishes itself as a mainstream payment platform. You can also check the scenario if you are using the other payment apps like if Cash App has buyer protection or if you use Zelle- is there any Buyer Protection.

Turning Off Purchase Protection on Venmo [Keep in mind the toggle purchase option]

A common issue that occurs nowadays is that you may accidentally toggle-on the option to mark a payment for purchase, when it is actually a payment for a personal transaction.

In such cases, the recipient of the payment gets hit with the purchase protection fees (i.e. 1.9% + $0.10) of the amount transferred.

So make sure you are careful and keep the toggle off for the payment for purchase of goods and services, when initiating the payment.

In case you have already gone ahead with the payment, you can reach out to the Venmo Support Team, who may be able to help you out in such cases.

What transactions are covered by Venmo Buyer Protection?

Venmo site mentions that “Qualifying payments” are eligible for the Venmo Purchase Protection Program. Qualifying payments include the following transactions:

- Venmo Debit Card purchases

- Purchases of goods and services from authorized merchants

- Payments sent using the Pay and Request feature that are sent to business profiles or identified as payment for goods and services

There are also specific conditions mentioned on what payments can be disputed by the Buyer and eligible for a refund.

What transactions are NOT covered by Venmo Buyer Protection?

Venmo website advises you to AVOID using Venmo to transact with people you don’t know well. Specifically, if such a transaction involves the purchase of goods and services (e.g. concert tickets, electronics, sneakers, watches, or other merchandise) which is not authorized by Venmo

The following transactions are classified as high risk, not allowed under Venmo’s User Agreement, where you are not covered by Venmo buyer protection

- If you as a Buyer make a Venmo payment to an unauthorized business profile or seller’s personal profile individual for a good or service without calling the payment as for goods and services

- If the Seller accepts a Venmo payment from someone for a good or service using a personal profile and the buyer didn’t identify a payment as for goods and services

For such transactions, Venmo may later review and reverse the payment, meaning you could lose both the payment and the item sold. This review process may not occur until after you attempt to transfer the funds out of Venmo.

Also, when you identify a transaction made through your Venmo account as not authorized by you, it is not a claim applicable under the Venmo Purchase Protection Program, and covered under “Protection from Unauthorized Transactions”

Venmo Purchase Protection fee

To be covered by Buyer Protection, Venmo charges the seller a small fee of 1.9% + $0.10 of the transaction. E.g. If the payment is $100, the seller would receive $98 and $2 would be used to pay the fee.

There is no fee for the buyer.

So whenever a buyer is using Venmo to purchase a good or service and make a payment to the seller’s personal profile, you can now specifically toggle on this option to call it out. This adds Purchase Protection to the transaction. However, the seller will have to pay a fee on such receipts, so be aware of that.

Venmo Purchase Protection Benefits? Can I get a refund on Venmo?

When you’re a buyer who makes a Qualifying Payment, you may be eligible to claim a refund under the Venmo Purchase Protection Program for the full purchase price of the item and any shipping costs you paid, if any.

When you’re a seller who receives a Qualifying Payment into your Venmo account, you retain the full purchase amount (less any fees we charged) from a sale under the Venmo Purchase Protection Program.

Venmo Buyer (Purchase) Protection claims

As a buyer on Venmo, you can claim Purchase Protection and encounter these specific problems with an eligible purchase:

- You didn’t receive the item you paid for (called an “Item Not Received” claim), or

- You received an item, but the item isn’t what you ordered (called a “Significantly Not as Described” claim)

You can refer to the Venmo website for detailed terms of Purchase Protection.

General buyer eligibility for Venmo Purchase Protection Program

To be eligible for the Venmo Purchase Protection Program, you as a Buyer must meet all of the following requirements:

You have a Venmo account in good standing.

- You have previously attempted to resolve the issue directly with the seller.

- You respond to our request for documentation and other information within the time requested.

- You open a dispute with us within 180 days of the date you made the purchase, then follow our dispute resolution process.

- You have not received a recovery related to such purchase from another source, for example from a dispute filed with your bank or credit card issuer.

What causes a payment to be on hold?

There is an inherent risk in online transactions, at times, Venmo may put a payment on hold and delay the credit to the seller’s account for up to 21 days.

Some of the common reasons for putting a payment on hold:

- when a seller is new with Venmo or has opened a new account

- Payment which is unusual for your selling pattern

- The seller’s Venmo account was inactive for a while

- You’re selling a product or service that can potentially cause dissatisfaction with customers

- Multiple customers reported problems or requested refunds

Wrap Up

So Venmo does offer buyer protection for authorized payments i.e.g payments to a Business Profile or payments to a personal profile which is identified as a payment for goods or services.

I recently had to use Venmo’s payment protection. The items I ordered ($90, plus $30 shipping) were “Significantly not as described.” Specifically, they were accessories for a totally different year and model car than what was stated.

I contacted the seller, and Venmo, and Venmo promised to look into it. In about a week, I saw the $120 show up in my bank account (not my Venmo account). There was NO communication from Venmo.

Two days later, the seller contacts me and asks if I am going to be sending the accessories back to him. Also, that VENMO had pulled $120 from his account! Venmo later confirmed this. Please note–the seller only earned $90. The $30 I paid for shipping went direct to shipping!

When I went to bat for this guy (I’m an idealist–so shoot me), VENMO customer support says that’s what they do. Even though their stated policy states the opposite.

Anyone else have similar issues?