If you use Cash App and don’t have access to the Borrow feature, you are on the right post to get the potential reasons. The Cash App Borrow feature is not available to all users and only shows up to eligible users, which is determined by Cash App based on an algorithm. This does leave many people wondering questions like “Why Cash App Borrow is not showing up” or “Why can’t I borrow money from Cash App” when there are other Cash App users who have access to it.

In this guide, we will dig into the reasons why you may not have access to the Cash App borrow feature and some alternative options you can consider.

With Cash App borrow, you can get a short-term loan for an amount usually up to $200. You are required to repay this loan in four weeks with a 5% fee. This is not cheap in any way as it adds up to 60% APY (5%*12 ).

Cash App borrow snapshot

- Eligibility– Algorithm based, factors like credit score, state, and direct deposit can influence the availability

- Maximum borrow limit: Usually $200 (can be higher)

- Repayment period: 4 weeks

- Charges: 5% flat fee

- Late fees: 1.25% per week post grace period of one week

The Cash App Borrow is a loan offered by Cash App in partnership with First Electronic Bank. You can check the terms of the Borrow agreement on the Cash App website.

Although the Borrow Feature has been around for quite some time, Cash App still mentions the feature is in the pilot phase and not rolled out to all users.

Further, access to this feature is algorithm-driven and depends on a number of factors discussed below.

Why is Cash App Borrow Not Showing Up

The Cash App borrow feature is not available to all Cash App users and only shows up if you are identified as an eligible user by the Cash App algorithm.

Your ability to access the Cash App borrow feature depends on a number of factors which include the following:

- State of residence

- Credit history

- Cash App usage

- Direct deposit enabled for a user’s Cash App account

- Cash Card usage

Let’s understand the details.

Hi there, the Borrow feature is slowly being rolled out to qualifying customers, you’ll be notified when the feature is available. Availability can be influenced by:

— Cash App Support (@CashSupport) July 19, 2022

– State of residence

– Credit history

– Cash App usage

– Direct deposit enabled for a users Cash App account

1. State of residence

The Cash App Borrow feature is not available yet in all US states and regions. It is being rolled out in stages.

In some states, you will see a high percentage of Cash App users who have the Cash App Borrow feature. While in the case of other states, it may not even be available.

If you see this feature is available to other Cash App users in your region, then you can skip this and jump to the other factors to understand the reason.

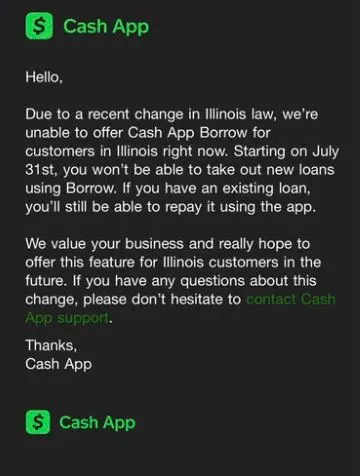

There has also been a recent update from Cash App wherein they have disabled the Borrow feature for users in Illinois to comply with the state law from July 31, 2022.

2. Credit History

Your credit score is another important factor that can impact your eligibility for Cash App’s Borrow feature.

A decent credit score definitely improves your chances. On the other hand, a low credit score may work against you.

This is also dynamic and a real-time check. There are also situations where a user’s access to Cash App borrow feature later ended or disappeared.

Some users who have access to the feature also felt that paying off Cash App Borrow loans has helped build their credit.

So it is one of the important inputs in the algorithm in getting access to the Cash App Borrow feature, although not the only factor.

3. Cash App Usage

If you use Cash App sparingly, it may be one of the factors depriving you of the Cash App Borrow feature.

Using Cash App to send and receive money with your family and friends is one easy use case.

You can increase the frequency of your transactions if it works for you.

Linking your bank account and or debit card to Cash App to move money to Cash App and cashing out from time to time may also help.

If you use Cash App other features like investing etc. may also favor you.

Again, it’s not very clear how significant this factor is in terms of using the various features of Cash App.

But if you have a fairly active Cash App account, it should not be an issue.

4. Direct deposit enabled for a user’s Cash App account

If you have a direct deposit set up with Cash App, this can be a factor in your favor.

This is not a must-have as there are Cash App users who have the Borrow feature even without a direct deposit.

On the other hand, some users with direct deposit don’t have access to the Borrow option yet.

I don’t have the borrow feature sadly. I have direct deposit too. It sure would help me if I did

— Mrs.V🤍 (@kasey_vowell) July 2, 2022

But it tilts the scale in your favor as Cash App has visibility on your payroll, which can serve as important input to know how much they can lend you.

5. Cash Card usage

If you have the Cash App Card, use it more often for your day-to-day purchases. You also get the Cash App Boost offers from time to time that can get you a discount benefit.

You can use Cash App Card at the gas station, for a coffee at Starbucks, buy groceries, get fast food, etc. All the purchases add up.

You can also make your bill payments or subscriptions using Cash App Card. Do keep in mind that Cash App does not offer overdrafts though.

Alternatives to Cash App Borrow

If you don’t have the Cash App borrow feature yet, don’t sweat about it.

There are cheaper alternatives available. As explained earlier, Cash App borrow interest rate is actually quite expensive. A 5% interest rate for a month is a 60% APY, which is quite a bit.

If you have direct deposit, a great alternative is Chime which offers Chime SpotMe® for members with a direct deposit of $200 or more. It does not have any interest or late charges.

You can do a voluntary tip. You can overdraft as well as withdraw cash from ATM or use cashback transactions up to your Spot Me limit which can range from $20 to $200.

Eligibility: Chime Checking account with a direct deposit of $200 or more

Fees: No fees or interest

Borrowing Limits: $20 up to $200 (auto-determined by Chime based on your account activity and history)

Uses: For purchases with Chime Debit Card, withdrawing cash at ATMs and retail stores (using cashback)

Repayment: Auto-deducted from your next direct deposit or other deposits

Other options that you look at include cash advance apps like Dave, Earnin, MoneyLion, Cleo, etc. that have lower fees.

Wrap Up

The Cash App borrow feature is a convenient option, but not available to all users and is not a cheap option. Cash App tends to be selective in letting you access this feature, as is the case with many of its other features. Some of the important factors that impact your eligibility are covered in this post. It is not a great idea to rely on it as the only option, even if you have access to it.