With Cash advance apps, you can access funds to cover short-term requirements at reasonable charges. If you have a Chime bank account and are looking for cash advance apps that support Chime, this post will help you get the complete list.

Cash Advance apps come in handy if you are in urgent need of funds to pay for expenses like rent, gas, groceries, etc. They allow you to borrow funds in advance of your payday to cover the cash requirements outside the normal pay cycle.

Cash advance apps turn out to be cheaper than payday loans and overdrafts where the interest rates can be exorbitant.

To get an advance, you need to link a bank account where you receive the direct deposit from your employer in these apps This helps them get visibility on your payday and paycheck amounts and accordingly determine how much advance can be extended to you.

Some of the popular cash advance apps include Brigit, Cleo, Albert, Earnin, MoneyLion, Dave, Klover, etc. However, NOT all cash advance apps work with a Chime account.

Let’s see the different cash advance apps and if they are compatible with Chime.

Here you may consider that Chime has its own overdraft product –Chime Spot Me®, that allows you to spot yourself cash up to a limit if you are an eligible user. You don’t have to worry about compatibility issues if you use Chime’s own product.

Contents

Cash Advance Apps that work with Chime [List]

Based on currently available information, below is a list of cash advance apps and their compatibility with Chime.

- Dave

- Klover

- Cleo

- MoneyLion

- Chime SpotMe

- Albert

Let’s look the details for all the advance apps and their compatibility with Chime.

| Cash Advance App | Works with Chime | Remarks |

|---|---|---|

| Albert | Yes | |

| Branch | Yes (for some users) | If you have set up direct deposit with Branch Wallet |

| Cleo | Yes | |

| Dave | Yes | |

| Earnin | Yes (for some users) | Works for selected users on a test basis |

| Empower | Yes | Some users face issues |

| Klover | Yes | Some users face issues |

| MoneyLion | Yes | |

| Chime SpotMe | Yes | |

| Brigit | No | Can work for some old users |

| Float Me | No |

So Cash advance apps like Cleo, MoneyLion, Branch, Dave, Albert, etc. all work well with Chime. While for Brigit and Earnin, it works only for a limited set of Chime users.

On those cash advance apps that support Chime, you can add either the Chime Debit Card or link your Chime bank account via Plaid to connect to these apps.

Let’s see this in more detail- what are the technicalities involved with each of the cash advance apps, the level of support for Chime, and any issues that you may face.

Brigit

Brigit is one of the popular cash advance apps, having more than 1.5 million users. Brigit does NOT work with Chime at this moment. As per the Brigit website support section providing information on the supported banks, Brigit is no longer supporting new users who have a Chime bank account, citing connectivity issues.

Brigit also does not support Varo and NetSpend.

Note: If you are thinking of using Varo, you can also check our guide on cash advance apps that are compatible with Varo.

Cleo

Cleo is one of the few cash advance apps that works fine with Chime. You can subscribe to Cleo Plus Service and link your Chime bank account or debit card to get the cash advance.

Overall, Cleo supports more than 3,000 US banks/providers and also lists Chime bank account as one of the top 10 banks that they support.

To use Cleo with Chime, you can connect your Chime Bank account in Cleo App.

Cleo is an AI-powered Chatbot app that works like a money management app that allows you to link a bank account, and analyze your deposits and spending pattern.

If you have used it for some time, Cleo also allows you to borrow interest-free funds (Salary advance) up to $100 for up to 28 days. For this, you have to subscribe to the Cleo Plus service based on your spending habits and fund balance.

MoneyLion

MoneyLion is one of the popular cash advance apps that work with Chime. MoneyLion is known to support Chime. To link Chime Account in MoneyLion, go to the “Finances” tab at the bottom of the MoneyLion home screen and then select “Link an account.” Select Chime bank from the list of options or use the search bar to find it.

There are a few things you should note in general while connecting Chime Bank Account to MoneyLion, to be eligible as per their terms.

- Your bank account should be active for at least two months and have regular deposits of income/paychecks

- Your bank account should have a positive balance

MoneyLion is a membership-based service that offers you the instacash option (without interest) of up to $250 ahead of payday. It also provides short-term loans.

Earnin

Earnin is another popular cash advance app that can work with Chime. As per the Earnin website, it is offering services to selected Chime users on a test basis. Earnin is working on improving its service to offer full-fledged support to Chime users.

You can check our complete guide on does Earnin accept Chime, which goes into detail about the reasons and experience of different Chime users with Earnin.

Apparently, there are complications in determining the pay schedule for Chime users, as they can receive their paycheck up to 2 days earlier.

So using Earnin with Chime is a bit of trial and error. You can try linking your Chime Bank Account in Earnin App, by going to Earnin App Settings Option -> then “My Bank” option. Search for Chime Bank and add your Chime bank details. See if you get the confirmation to know if you are one of the lucky Chime users which Earnin supports.

If you get a confirmation from Earnin that your Chime Account is successfully linked, make sure to turn on the “Allow Transactions” option in your Chime Account settings. This gives Earnin the permission to send “Cash Outs” to your Chime account and auto-debit your account on payday.

Earnin doesn’t charge any interest and charges on paying, but it does ask for a tip when you opt for it to advance money on your paycheck.

Branch

Another popular app that offers an advance against your paycheck is the Branch app. While Branch can work for Chime users, there is a catch. As per the Branch Support, if you bank with Chime, you will be required to put your direct deposit in your Branch Wallet to qualify for an advance.

The amount of advance you can get on Branch depends on the number of hours you have worked and the wages (usually capped at $500 per pay period). While there are no interest or charges involved here, there is a tip that you can pay. But, if you want to access funds instantly, it does charge fees of $3.99.

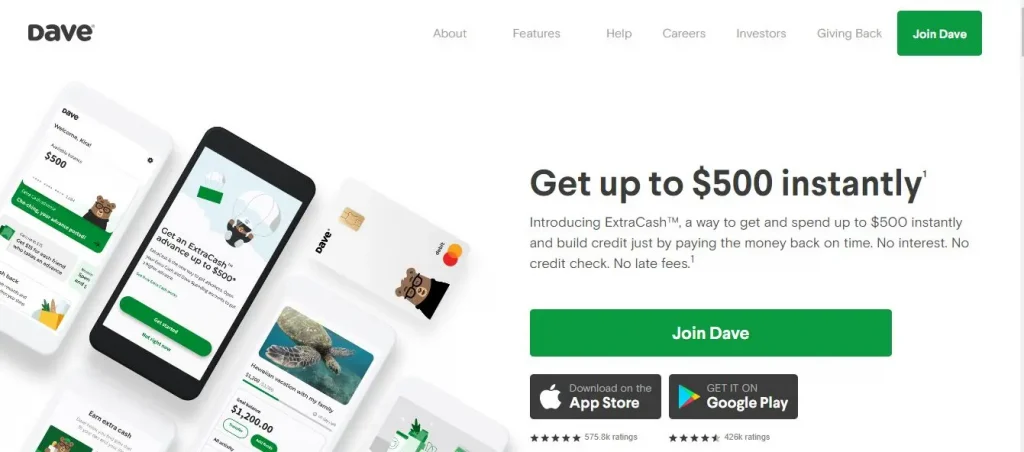

Dave

Dave is one of the cash advance apps that allows users to link their Chime Accounts. It seems there are no issues for users banking with Chime with Dave. Dave usually provides cash advances to cover small expenses (up to $500). It works on voluntary tips but also charges a monthly subscription fee of $1.

Dave

Key Features

- Maximum up to $500 cash advance

- Monthly1$ membership fee

- No interest or credit check required

- Link external bank account with direct deposit or open Dave Spending account

Albert

Albert is another one of the cash advance apps that works fine with Chime. You can connect your Chime Account with Albert and can get a cash advance against your next paycheck.

Albert offers advances ranging from $100 up to a maximum of $250, depending upon your income. Again there is no interest or late fees charged by Albert.

However, like other apps, Albert works on a subscription model with a fee of $3.99 per month.

If you want to advance instantly, you need to pay a $4.99 delivery fee.

Klover

The Klover app is another paycheck advance app that is compatible with Chime. While Klover does not charge you interest, charges, or checks your credit score. Instead, it earns money through advertising by serving you custom ads based on your profile.

The usual amount of Klover advance you can get varies from $100 to $500. You need to at least 3 direct deposits to qualify for a paycheck advance.

Klover also offers a points program for advance amount upgrades ($10-$30), which has a lower limit of $20 if you are banking with Chime and Varo.

Empower

Yes, Empower App is another cash advance app that works with Chime. To link your Chime account with Empower, go to the home page of Empower app, scroll down to Accounts Section and tap on the “+” icon to add your Chime account using online banking details.

It allows eligible members (Which requires setting up a checking account) to get an interest-free advance of up to $250.

There is some criteria to be eligible like a healthy current account balance, recurring deposits from the employer, and balance history for Empower to qualify. It also charges a monthly subscription of $8.

Float Me

No, Float Me does not work with Chime. As per the information mentioned on both Google/Apple App Store, FloatMe does NOT support Chime, Varo, or prepaid cards at this moment.

While things may change in the future and you should see the current information, when you try linking Chime with FloatMe.

Grid

No, Grid does NOT work with Chime Bank at the moment.

As per available information shared on their app page, Grid does not support users of Chime and Varo banks.

However, the cash advance app is working to expand the list of the banks they currently support.

Vola

Vola, founded in 2017, is a relatively new player in payday loans segment that offers upto $300 advance. You have to subscribe to get the advance by paying a membership fee starting at $2.99.

No, Vola is another example of the payday loan apps that does not support Chime or Varo.

Chime SpotMe

You can use Chime’s own product- Chime SpotMe® which allows you an overdraft of up to $200 (Starting from $20) without any fees. SpotMe applies to debit card purchases and cash withdrawals for eligible members. To qualify, you need to open an account with Chime and set up a direct deposit of $200 or more in your Chime Spending account.

The Chime Spot limit is the maximum amount you can borrow. It is auto-determined by Chime based on your account history and activity. You can enroll in Chime SpotMe by going to the Settings Tab (make sure you have the latest version of their app) and see if you are eligible.

You can use Chime Spot Me

- To overdraw your account up to Spot Me Limit for purchases on your Chime Debit Card

- Withdraw cash up to your limit from ATM or by performing Cashback transactions at retail stores.

In fact, Chime Spot Me allows you to even send Spot Me Boosts to other Chime users who can get a temporary increase in their Chime Spot Me Limit by $5 per boost. Probably, a thing to consider for Christmas.

Note: Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime checking account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member’s Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime’s discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won’t cover non-debit card transactions, including ACH transfers, Pay Friends transfers, or Chime Checkbook transactions. See terms and conditions. <(https://www.chime.com/policies/bancorp/spotme_terms)

FAQ

Are Cash Advance Apps Worth It?

While Cash advance apps do turn out to be a cheaper option as compared to Payday Loans and overdrafts which come with exorbitant charges, you should be cautious to avoid overusing it.

Don’t depend on it for your funds, as they also lead to a debt trap. This article from Times is a good read on why Cash advancce Apps should be avoided in the long term.

If you see yourself using them more than 2 to 3 times, it’s probably time to look at how you manage your money overall.

You can look at ways to develop some side income as a long-term solution– to take care of your urgent expenses that may come outside of your pay cycle.

Do Cash Advance Apps Require Credit Check?

Most modern Cash Advance Apps do not require a check on your credit score and use their own algorithms to determine how much they can lend to you based on a review of your income via direct deposit, spending habits, etc.

Even in a few apps where the credit check is done, it is mostly a soft check which does not impact your credit score.

Hope this post was helpful in knowing the Cash advance apps supporting Chime.